HMRC state:

“Work that advances overall knowledge or capability in a field of science or technology, and projects and activities that help resolve scientific or technological uncertainties, may qualify for R&D relief. The relief is not just for ‘white coat’ scientific research, but also for ‘brown coat’ development work in design and engineering that involves overcoming difficult technological problems.”

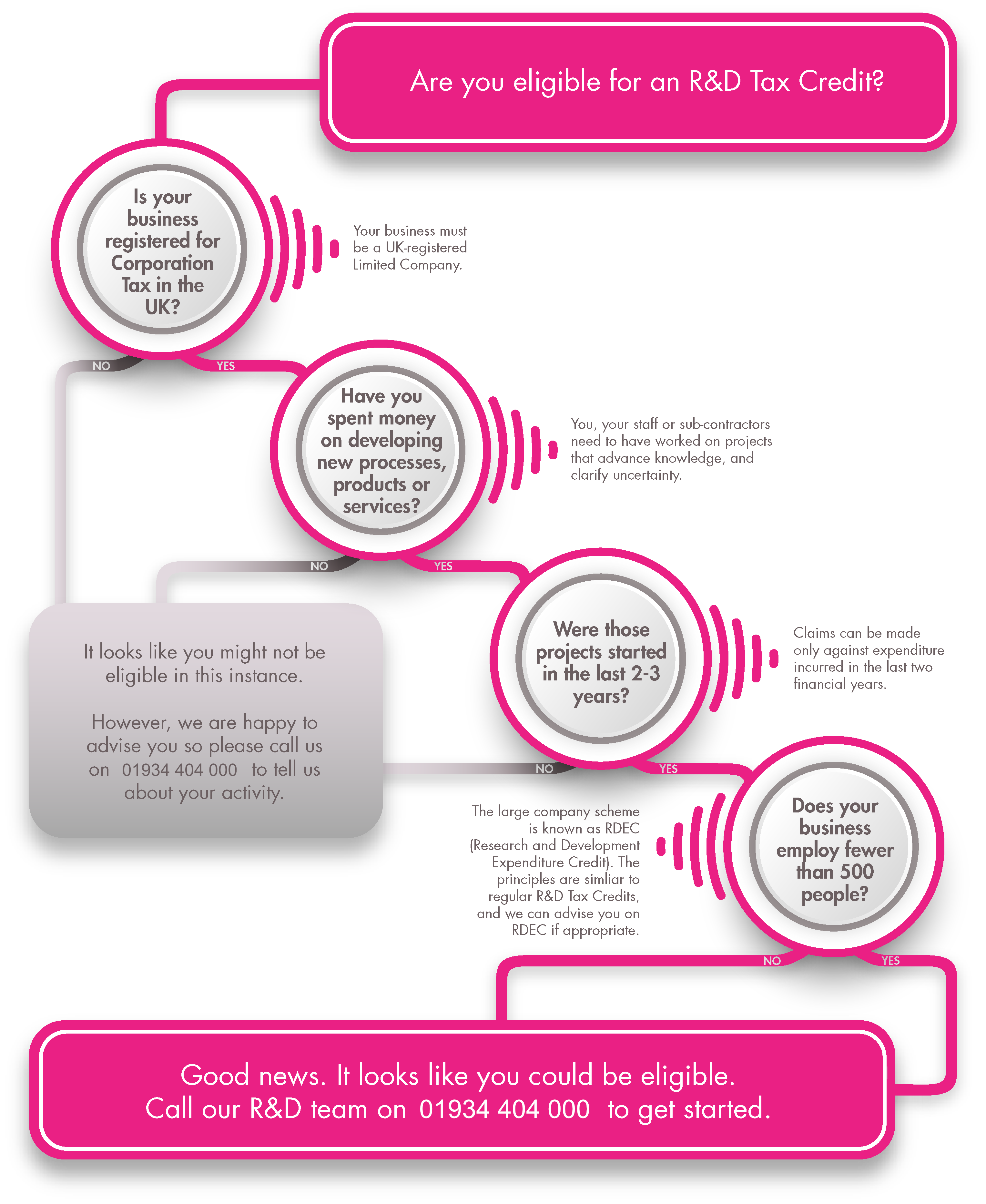

If you think you might be eligible, ask yourself the following questions:

- Is my business a Limited Company, registered in the UK?

- Does my company have a project or have we incurred expenditure on one in the last couple of years?

- Are we seeking an advance in a field of science or technology?

- Does the advance extend the overall knowledge or capability in the field of science or technology, and not just the company’s own state of knowledge or capability?

- Does the project involve an uncertainty that competent professionals can’t readily resolve and where solutions aren’t common knowledge?

If you can answer ‘Yes’ to all these questions, then you just might be able to make a claim.

Our 6 step process

- Check Eligibility: Determine if your work qualifies as R&D, and explore the different reliefs available. This is typically during a face to face meeting, or over a Teams video call. We really need to get into the detail of it all and so typically this will involve discussions with the experts completing the work alongside the management team providing the direction.

- The numbers: On conclusion of the meeting, we request copies of the accounts and supporting information to calculate the value of the claim. We are fully transparent with our fees, and we highlight our fees based on the value of the claim.

- The report: Once the numbers are agreed, we work with your technical experts to write up a detailed report to submit to HMRC alongside your tax return.

- Notify HMRC: For accounting periods starting after 1 April 2023, inform HMRC if you plan to claim R&D tax relief.

- Submit Detailed Information: From 8 August 2023, complete an additional information form to support your claim

- Submit the return & wait for your tax credit: Potentially up to 33p in every £1 of the costs you incurred in the activity prior to April 2023 and up to 27p in every £1 after that point (RDEC claims are structured differently and have a different rate of return).

Testimonials

What our clients say about us

Mike Perry

The whole team are incredibly helpful and great at what they do. I can't recommend them enough!

Malia Brown

Thank you to [The Phinch] team for all your support over the years. It's very much appreciated and valued.

Grace Eden

Excellent guidance through process with a high degree of expertise. A very smooth experience.

Jennifer Muller

I have used [Phinch] services for many years. [The] team have guided me through the complicated processes of US taxes as an expat, and stayed on top of any changes in filing rules. Highly recommended.

Larissa Bulla

[The Phinch] team have been incredibly helpful in the preparation and filing of my US tax returns and FBAR submissions, even when I have been less than fully organised. The team are always prompt and professional. They stay abreast of changes in annual tax rulings and have helped me secure rebates or stimulus payments where these are due. I highly recommend this company.