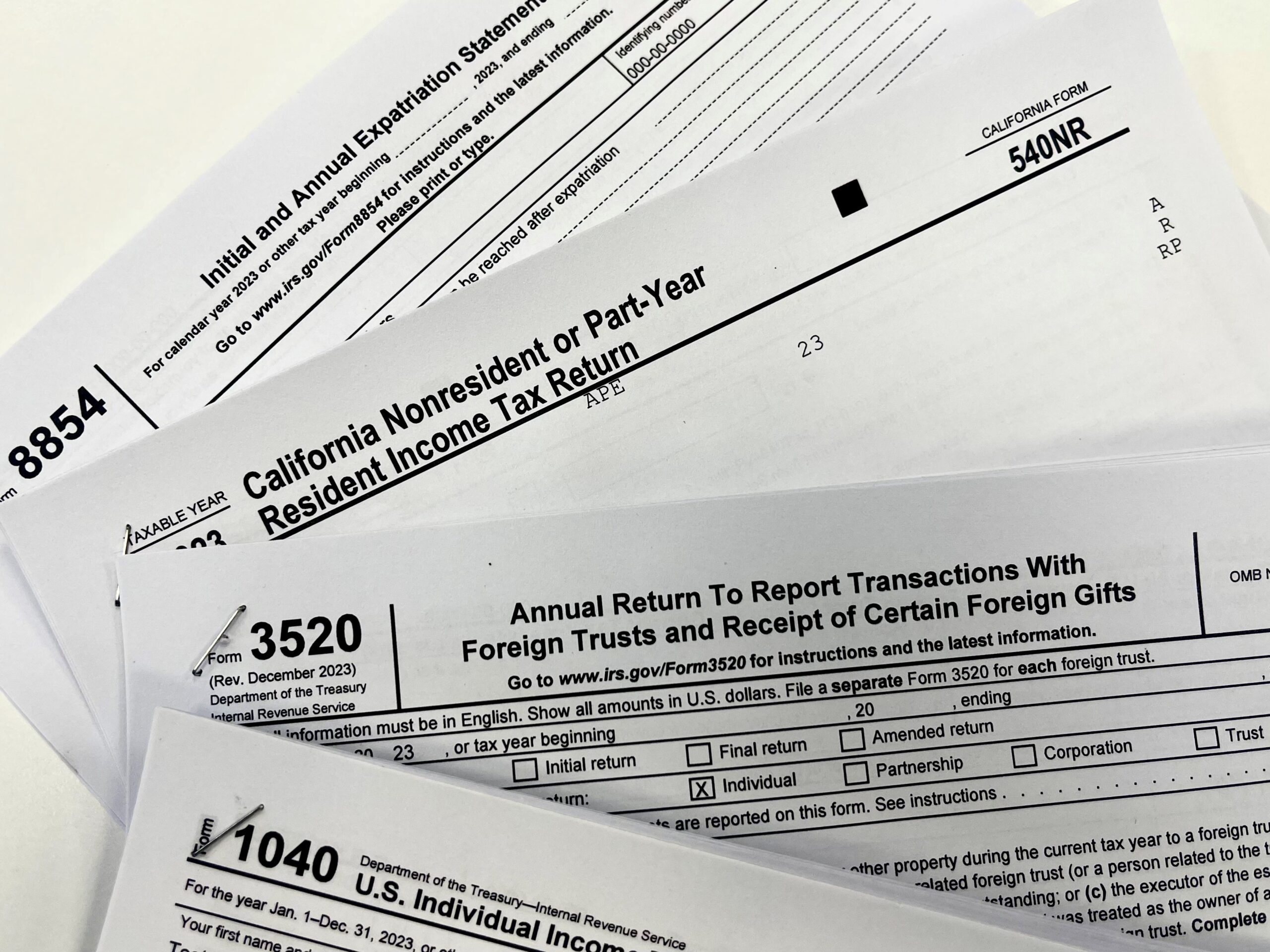

US Tax Returns in the UK

Whether you are a US Citizen, Green Card holder or you simply own assets based in the USA, you will be required to complete and file an Annual US Tax Return. Our team specialises in the preparation and submission of US Tax Returns for non-US resident expatriates and UK investors.

Who needs to file US returns?

US Citizens and Greencard holders

The US is one of the only countries in the world that taxes its citizens on their worldwide income, no matter where they live. Under the US tax system, US persons are required to file annual US income tax returns detailing their worldwide income and gains.

Non-US Persons with US Investments

Non-US persons must also comply with the US tax rules, and file US Returns, if they have investments or income/gains arising in the United States.

Foreign Bank Account Returns (FBAR) or FinCEN 114

If you are a US citizen, resident or Greencard holder and you have a foreign bank account or are a signatory on a foreign bank account, you may be required to file a report called an FBAR or FinCEN Form 114 (formerly known as TD F 90-22.1), in addition to your annual US tax return filing responsibility.

The FBAR has a filing deadline of April 15 (adjusted for weekends), however a six-month extension of the filing deadline is available without a specific extension request. This moves the filing deadline to October 15th (adjusted for weekends).

The FBAR covers all foreign bank accounts, pension accounts, trust accounts, and business accounts, which you have a financial or beneficial interest in or signature authority. A return is required if the combined sum of the maximum balances of the accounts exceeds $10,000 for the year.

Failure to file FinCEN Form 114 by the deadline can carry a penalty of $10,000 per account.

US Citizens with Foreign Corporation Return Declarations

If you are a shareholder in a non-US corporation, there may be additional filing obligations when preparing your US Tax return.

Form 5471 must be completed for any US citizen or Greencard holder who owns 10% or more of the shares in a non-US company at any point during the tax year. A separate form is required for each non-US company you are a shareholder in. The Form reports your shareholding at the beginning and end of the year, as well as the balance sheet and profit and loss account of the company.

The completed Form 5471 must be filed with your annual US Federal Return. If the form is filed late or contains incomplete or inaccurate information, the IRS can charge penalties to taxpayers of up to $10,000 per form.

Important deadlines

-

January 1st

Start of US Tax Year.

-

January 15th

4th Quarterly Federal & State Tax Payments due.

-

March 15th

Deadline for S Corporation Returns (Form 1120-S) unless extension applied for.

-

March 16th

Deadline for Partnership Returns (Form 1065) unless extension applied for.

-

April 15th

Deadline for submitting US Federal and state tax returns without automatic overseas extension or extension application.

Deadline for submitting Federal Income Tax Return Extension application.

Deadline for submitting C-Corporation Income Tax returns (Form 1120) unless extension applied for.

1st Quarterly Federal & State Tax Payments due for the current tax year.

FinCen (FBAR) filing deadline – subject to automatic extension to October 15th. -

June 15th

Deadline for submitting US Federal and state tax returns with automatic overseas extension (unless extension application submitted).

2nd Quarterly current tax year Federal & State Tax Payments due. -

September 15th

3rd Quarterly current tax year Federal & State Tax Payments due.

Deadline for extended Partnership Returns (Form 1065).

Deadline for extended S- Corporation Returns (Form 1120-S). -

October 15th

Deadline for submitting extended US Federal and State tax returns.

Deadline for extended C- Corporation Returns (Form 1120).

Extended 2020 FinCen (FBAR) filing deadline. -

December 31st

End of US Tax Year.

Testimonials

What our clients say about us

Rahul Moodgal

Just incredible. So responsive, detailed but without loosing you with technical jargon and really answered my questions. Will recommend time and time again! Simply the best!

Jane Jarzebowski

My husband & I returned to the UK after a long period of living abroad. Phinch were highly recommended to us as a business that was both professional and compassionate. We have received excellent advice & support from everyone who has helped us and we continue to do so. Thank you so much to you all.

Maurits Kleijnen

I have had, for several years running now, an excellent experience with Phinch for the preparation and filing of US tax returns. They are professional, highly responsive, and fully knowledgeable about the complicated and ever-changing US tax system. All in all, a great partner to have when you need to deal with the US Internal Revenue Service. Trustworthy and dependable.

Larissa Bulla

[The Phinch] team have been incredibly helpful in the preparation and filing of my US tax returns and FBAR submissions, even when I have been less than fully organised. The team are always prompt and professional. They stay abreast of changes in annual tax rulings and have helped me secure rebates or stimulus payments where these are due. I highly recommend this company.