Cryptocurrencies are becoming increasingly popular as part of an individual investment portfolio. Despite this, the tax implications of making such investments are not commonly known, therefore it is important that you take professional advice from qualified and experienced tax advisers who are familiar with cryptocurrency.

Phinch has experience in dealing with a wide range of inquiries from individuals and businesses seeking tax advice about the cryptocurrency market and assistance with their R&D Tax Reliefs claims, where we are seeing companies integrate Blockchain technology into their supply chain and creating their own Cryptocurrency for specific projects.

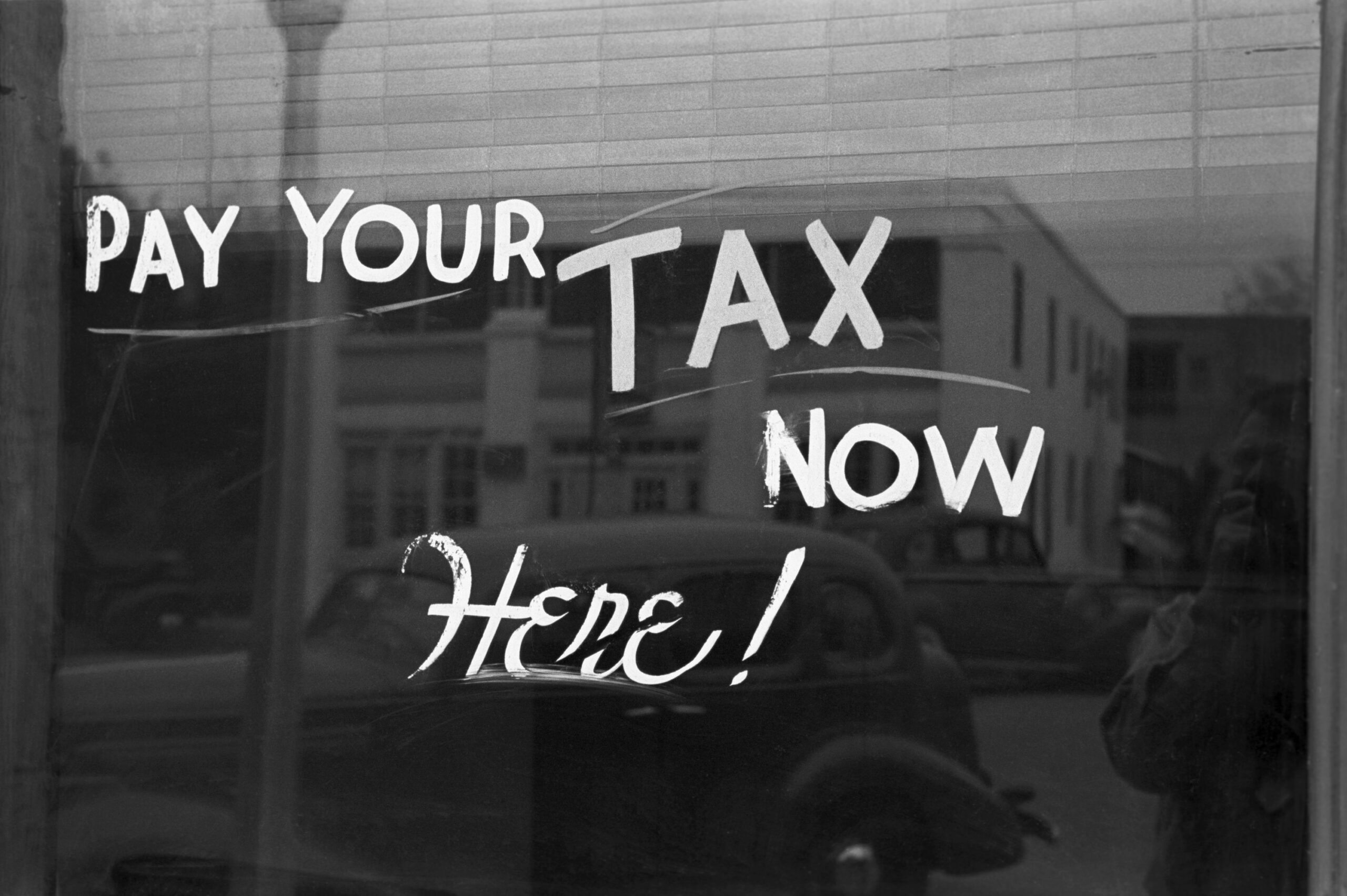

Contrary to popular belief, you must report income from Cryptocurrency investments and mining-related activities. Most of the Cryptocurrency investors think that they are exempt from reporting the gain to HMRC but if you have made any gain or profit from cryptocurrency activities, you may need to report your gain profit to HMRC.

Our dedicated Cryptocurrency tax experts can advise you on the tax implications of Bitcoin and other cryptocurrency-related transactions and ensure that all tax compliance reporting requirements are made precisely and promptly to HMRC.

In addition to offering advice on a broad range of conventional tax advisory services, we also offer three highly specialised areas of expertise: US Tax advice for US citizens living in the UK; and assistance for UK companies wishing to claim Creative Industry Tax Reliefs and/or Research & Development Tax Credits.